Home Prices Are Rebounding

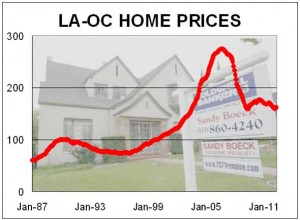

Blog, Market Updates, Real Estate Tips | Dunham Stewart This US Report suggests what we are experiencing in our local housing market. We have seen a positive turn in 2012, and the popular opinion is that we will continue to see an improving real estate market. We have begun to see some rising home prices in the region, continuing a slight rebound for a second straight month. While one month does not make a trend, particularly during seasonally strong buying months, the combination of rising positive monthly index levels and improving annual returns is a good sign. Although home prices have not necessarily seen a significant increase, we have seen an increase and speed of which homes are selling – and with a lot of sales for over-asking price. The expecttions is that only a matter of time until the market clearly reflects an increase in home prices. We are expecting home prices to cautiously start moving up into and thrrough 2013. Click this link to view the US Housing Report

This US Report suggests what we are experiencing in our local housing market. We have seen a positive turn in 2012, and the popular opinion is that we will continue to see an improving real estate market. We have begun to see some rising home prices in the region, continuing a slight rebound for a second straight month. While one month does not make a trend, particularly during seasonally strong buying months, the combination of rising positive monthly index levels and improving annual returns is a good sign. Although home prices have not necessarily seen a significant increase, we have seen an increase and speed of which homes are selling – and with a lot of sales for over-asking price. The expecttions is that only a matter of time until the market clearly reflects an increase in home prices. We are expecting home prices to cautiously start moving up into and thrrough 2013. Click this link to view the US Housing Report

Negative equity, which is the result of homeowners owing more on their mortgages than their homes are worth, has always been viewed as a detriment to the housing economy because it freezes owners in their homes and makes them liable to foreclosure. At a recent panel at the National Association of Realtors conference, Zillow’s chief economist put a different spin on negative equity. Stan Humphries argued that current market conditions, when inventories are at record lows and negative equity afflicts 31.4 percent of all homeowners with a mortgage, negative equity is not only diminishing demand it is also reducing the available supply of homes for sale by making it impossible for owners to sell without taking a loss. Lower inventories lead to price increases and at some point values rise sufficiently to move number of owners above water, and making it possible for them to sell, resulting in a temporary increase in inventories. Prices might plateau temporarily until demand reduces inventories again and prices resume their climb. The expecttion is for median prices to rise ten percent on an annual basis a year from now.

Negative equity, which is the result of homeowners owing more on their mortgages than their homes are worth, has always been viewed as a detriment to the housing economy because it freezes owners in their homes and makes them liable to foreclosure. At a recent panel at the National Association of Realtors conference, Zillow’s chief economist put a different spin on negative equity. Stan Humphries argued that current market conditions, when inventories are at record lows and negative equity afflicts 31.4 percent of all homeowners with a mortgage, negative equity is not only diminishing demand it is also reducing the available supply of homes for sale by making it impossible for owners to sell without taking a loss. Lower inventories lead to price increases and at some point values rise sufficiently to move number of owners above water, and making it possible for them to sell, resulting in a temporary increase in inventories. Prices might plateau temporarily until demand reduces inventories again and prices resume their climb. The expecttion is for median prices to rise ten percent on an annual basis a year from now.

Housing affordability conditions have reached the highest level since recordkeeping began in 1970, according to the National Association of Realtors®. NAR’s Housing Affordability Index rose to a record high 206.1 in January, based on the relationship between median home price, median family income and average mortgage interest rate. The higher the index, the greater the household purchasing power. An index of 100 is defined as the point where a median-income household has exactly enough income to qualify for the purchase of a median-priced existing single-family homeThe projections for the affordability index for all of 2012 will be at an annual high, with little movement in mortgage interest rates or home prices during the year. Read the full story at Realor.org:

Housing affordability conditions have reached the highest level since recordkeeping began in 1970, according to the National Association of Realtors®. NAR’s Housing Affordability Index rose to a record high 206.1 in January, based on the relationship between median home price, median family income and average mortgage interest rate. The higher the index, the greater the household purchasing power. An index of 100 is defined as the point where a median-income household has exactly enough income to qualify for the purchase of a median-priced existing single-family homeThe projections for the affordability index for all of 2012 will be at an annual high, with little movement in mortgage interest rates or home prices during the year. Read the full story at Realor.org:  Growth in home sales appears to be driven by the willingness of sellers to lower their prices rather than a broad-based increase in demand and buyer confidence, according to an analysis by real estate data and analytics firm Radar Logic Inc. In “

Growth in home sales appears to be driven by the willingness of sellers to lower their prices rather than a broad-based increase in demand and buyer confidence, according to an analysis by real estate data and analytics firm Radar Logic Inc. In “ More Americans are signing contracts to buy existing homes than at any time in nearly two years, boosting the housing industry’s slow recovery, according to the National Association of REALTORS®’ index of pending home sales. Last month saw the highest point on the index since April 2010, when consumers drawn by a home-buyer tax credit pushed the figure to 111.3. That was the last time the measure exceeded 100 — the benchmark for industry health. The index showed year-over-year increases in every region.

More Americans are signing contracts to buy existing homes than at any time in nearly two years, boosting the housing industry’s slow recovery, according to the National Association of REALTORS®’ index of pending home sales. Last month saw the highest point on the index since April 2010, when consumers drawn by a home-buyer tax credit pushed the figure to 111.3. That was the last time the measure exceeded 100 — the benchmark for industry health. The index showed year-over-year increases in every region.

With the start of the home buying season just around the corner, years of low prices and dashed hopes for the long awaited housing recovery may be changing the way sellers price and prep their properties. More than half (51 percent) of 600 agents in a recent real estate franchise survey reported that sellers are more willing to price their homes competitively than this time last year and 45 percent said sellers are more willing to change the appearance of their homes to entice buyers than they were one year ago. Last year, by contrast, many sellers refused to budge on their prices. One reason was the high percentage, some 22 percent of home owners with a mortgage, who owe more thantheir home is currently worth are not in a position to negotiate. Also, some sellers were willing to wait in hopes of getting a higher price. A factor currently working in sellers’ favor is a dramatically lower number of homes for sale, which may change with spring time. The national for-sale inventory dropped by 6.59 percent in January, the eighth consecutive month of decline. The total number of listings on Realtor.com is now 23.20 percent below the levels observed in January 2011.

With the start of the home buying season just around the corner, years of low prices and dashed hopes for the long awaited housing recovery may be changing the way sellers price and prep their properties. More than half (51 percent) of 600 agents in a recent real estate franchise survey reported that sellers are more willing to price their homes competitively than this time last year and 45 percent said sellers are more willing to change the appearance of their homes to entice buyers than they were one year ago. Last year, by contrast, many sellers refused to budge on their prices. One reason was the high percentage, some 22 percent of home owners with a mortgage, who owe more thantheir home is currently worth are not in a position to negotiate. Also, some sellers were willing to wait in hopes of getting a higher price. A factor currently working in sellers’ favor is a dramatically lower number of homes for sale, which may change with spring time. The national for-sale inventory dropped by 6.59 percent in January, the eighth consecutive month of decline. The total number of listings on Realtor.com is now 23.20 percent below the levels observed in January 2011.

When will housing come back in California? Three experts offer their views. South Bay Brokers invited California experts for their take on the state of real estate and what they think is needed to get the housing market moving again. They range from the pessimism of a banking executive to the more upbeat view of a Realtor association economist. California home sales and median price are predicted to improve only slightly in 2012. For details on what Mark Vitner, Managing Director and Senior Economist, Wells Fargo Securities projects you can download his presentation:

When will housing come back in California? Three experts offer their views. South Bay Brokers invited California experts for their take on the state of real estate and what they think is needed to get the housing market moving again. They range from the pessimism of a banking executive to the more upbeat view of a Realtor association economist. California home sales and median price are predicted to improve only slightly in 2012. For details on what Mark Vitner, Managing Director and Senior Economist, Wells Fargo Securities projects you can download his presentation:  Happy New Year! South Bay Brokers is starting the year off with great news. We are happy to report, as you will read in the first article, that it looks like economic conditions are pointing toward a brighter 2012 with low interest rates, improving employment figures, low inventory – pent up demand and price stability. In order to learn more about the improving Economic Momentum, South Bay Brokers is hosting a expert Super Panel. These expert economists will be discussing our local, state and national, economic status February 8th at the Crowne Plaza in Redondo Beach. Please be sure to RSVP by January 31st. Hope you can make it! Read more:

Happy New Year! South Bay Brokers is starting the year off with great news. We are happy to report, as you will read in the first article, that it looks like economic conditions are pointing toward a brighter 2012 with low interest rates, improving employment figures, low inventory – pent up demand and price stability. In order to learn more about the improving Economic Momentum, South Bay Brokers is hosting a expert Super Panel. These expert economists will be discussing our local, state and national, economic status February 8th at the Crowne Plaza in Redondo Beach. Please be sure to RSVP by January 31st. Hope you can make it! Read more: