Hermosa Beach Real Estate Deal of the Week

Blog, Deal of the Week, Hermosa Beach News, Real Estate Tips | Dunham Stewart {Video} Hermosa Beach real estate market Deal of the Week. Located in one of Hermosa Beach’s most coveted neighborhoods this home for sale offers: 4 bedrooms plus a loft style office; 3 baths; french doors leading to a deck located off the kitchen and living room allowing for a great entertaining space; grand floor to ceiling walls and fireplace in the living room; kitchen with it’s own dining area as well as another dining space for larger gatherings; 3 bedrooms are located on the second level where you will also find the loft style office overlooking the living room and another outdoor deck with pretty views of the valley and hill section; the private master bedroom h…as 2 closets and a master bath with a dry sauna.

{Video} Hermosa Beach real estate market Deal of the Week. Located in one of Hermosa Beach’s most coveted neighborhoods this home for sale offers: 4 bedrooms plus a loft style office; 3 baths; french doors leading to a deck located off the kitchen and living room allowing for a great entertaining space; grand floor to ceiling walls and fireplace in the living room; kitchen with it’s own dining area as well as another dining space for larger gatherings; 3 bedrooms are located on the second level where you will also find the loft style office overlooking the living room and another outdoor deck with pretty views of the valley and hill section; the private master bedroom h…as 2 closets and a master bath with a dry sauna.

The guest bedroom is located on the first floor with it’s own bath and separate entrance; Laundry room conveniently located on the second floor; 3 car parking; White washed, wire brushed oak flooring throughout gives a beachy feel to this fabulous home; 29th Street is a one way street with very little traffic; just three blocks to the beach and two blocks to Valley park; within quick distance to casual and fine dining. This Hermosa Beach home for sale is a great neighborhood..block parties..fun trick or treating..a beautiful home to raise your family. Great deal in the Hermosa Beach real estate market.

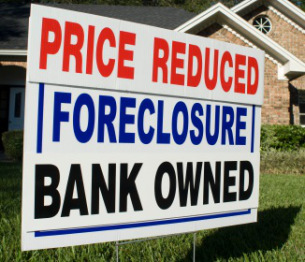

A very encouraging trend in the real estate market is the rising participation of trade-up buyers. Housing demand by trade-up buyers is rising as the home equity available to these prospective buyers is improving. On the demand side, steadily rising home prices and an expectation of continued recovery have stimulated housing turnover by prospective buyers who are in a position to take advantage of low home prices. In the meantime, higher home prices are bringing out trade-up demand from existing homeowners who are experiencing rising home equity, which supports a down payment on their next bigger house. An important sign of a healthy and sustainable recovery is increased housing turnover driven by trade-up buying, which is more or less discretionary spending. According to FNC’s Foreclosure Market Report, the foreclosure market has rapidly improved in recent months with foreclosure rates approaching pre-crisis levels – an indication of strengthening supply-side conditions. The report shows that foreclosure price discounts, which compare a foreclosed home’s estimated market value to the price paid by investors or home buyers, have dropped to a 10-year low.

A very encouraging trend in the real estate market is the rising participation of trade-up buyers. Housing demand by trade-up buyers is rising as the home equity available to these prospective buyers is improving. On the demand side, steadily rising home prices and an expectation of continued recovery have stimulated housing turnover by prospective buyers who are in a position to take advantage of low home prices. In the meantime, higher home prices are bringing out trade-up demand from existing homeowners who are experiencing rising home equity, which supports a down payment on their next bigger house. An important sign of a healthy and sustainable recovery is increased housing turnover driven by trade-up buying, which is more or less discretionary spending. According to FNC’s Foreclosure Market Report, the foreclosure market has rapidly improved in recent months with foreclosure rates approaching pre-crisis levels – an indication of strengthening supply-side conditions. The report shows that foreclosure price discounts, which compare a foreclosed home’s estimated market value to the price paid by investors or home buyers, have dropped to a 10-year low.

Existing-home sales increased in August, reaching their highest level in 6 1/2 years. What’s more, the median price shows nine consecutive months of double-digit year-over-year increases, according to the National Association of REALTORS®. Sales are at the highest pace since February 2007, when they hit 5.79 million, and have remained above year-ago levels for the past 26 months. The median time on market for all homes was 43 days in August, little changed from 42 days in July, but is much faster than the 70 days on market in August 2012. Total housing inventory at the end of August increased 0.4 percent to 2.25 million existing homes available for sale, which represents a 4.9-month supply at the current sales pace, down from a 5.0-month supply in July. Unsold inventory is 6.3 percent below a year ago, when there was a 6-month supply. Limited inventory in some areas means multiple bidding remains a factor; 17 percent of all homes sold above the asking price in August. As the equity position of most homeowners continues to improve, some who have been on the sidelines will list their home for sale. Current home owners—whether move-up, move-down, or move-over buyers—accounted for nearly 45 percent of the market share in home sales. Meanwhile, first-time home buyers are still being held back, with a slight drop in their market share from 36 percent to 35.7 percent month over month. The investor share in home purchases dropped to 19.7 percent from 23.1 percent.

Existing-home sales increased in August, reaching their highest level in 6 1/2 years. What’s more, the median price shows nine consecutive months of double-digit year-over-year increases, according to the National Association of REALTORS®. Sales are at the highest pace since February 2007, when they hit 5.79 million, and have remained above year-ago levels for the past 26 months. The median time on market for all homes was 43 days in August, little changed from 42 days in July, but is much faster than the 70 days on market in August 2012. Total housing inventory at the end of August increased 0.4 percent to 2.25 million existing homes available for sale, which represents a 4.9-month supply at the current sales pace, down from a 5.0-month supply in July. Unsold inventory is 6.3 percent below a year ago, when there was a 6-month supply. Limited inventory in some areas means multiple bidding remains a factor; 17 percent of all homes sold above the asking price in August. As the equity position of most homeowners continues to improve, some who have been on the sidelines will list their home for sale. Current home owners—whether move-up, move-down, or move-over buyers—accounted for nearly 45 percent of the market share in home sales. Meanwhile, first-time home buyers are still being held back, with a slight drop in their market share from 36 percent to 35.7 percent month over month. The investor share in home purchases dropped to 19.7 percent from 23.1 percent.

The proportion of investors involved in the housing market has fallen in the last few months. As their numbers dwindle, it may allow other buyers to step in, according to housing experts.In recent years, many buyers—particularly first-time home buyers—may have lost out to investors’ all-cash offers on homes. Banks and sellers may have been lured by the idea of a quick deal that cash offers typically provide over offers from buyers who require financing. But with less competition from investors, some housing experts say this may allow an opportunity for other potential buyers to get into the market. Investors have gone from accounting for 23 percent of home purchases in February to about 20 percent in June—the lowest level since September 2012, according to data from Campbell/Inside Mortgage Finance survey. With mortgage rates rising in anticipation of the

The proportion of investors involved in the housing market has fallen in the last few months. As their numbers dwindle, it may allow other buyers to step in, according to housing experts.In recent years, many buyers—particularly first-time home buyers—may have lost out to investors’ all-cash offers on homes. Banks and sellers may have been lured by the idea of a quick deal that cash offers typically provide over offers from buyers who require financing. But with less competition from investors, some housing experts say this may allow an opportunity for other potential buyers to get into the market. Investors have gone from accounting for 23 percent of home purchases in February to about 20 percent in June—the lowest level since September 2012, according to data from Campbell/Inside Mortgage Finance survey. With mortgage rates rising in anticipation of the  Two years ago, foreclosures regularly sold for 30 percent or more below the price of “normal” homes. How times have change! Now the foreclosure discount is less than half that amount and still headed south. The discounts investors receive for buying homes that have languished in default, are what attracted most investors to real estate in the first place. Foreclosure discounts, however, were also widely blamed-fairly or unfairly–for lowering home values when appraisers mixed them in with other comparable properties when valuing a home. This practice was so controversial that it contributed to a two-year long, highly charged re-do of appraisal guidelines and today appraisers are discouraged from using foreclosures as comps. As the discount has declined, the problem with appraisals is disappearing but investors are facing some tough decisions. The latest data, from the National Association of Realtors Realtor Confidence Index survey of 3400 plus Realtors suggests that for REOs the discount has fallen to 16 percent average discount to market, while short sales are selling at a 13 percent average discount. For properties in average or better condition, the discount is now only 11 percent. The demise of the foreclosure discount may become a major factor in changing the nature of residential real estate investing. Despite the entry of big investors into real estate, small “mom and pops” still account for the vast majority of foreclosure sales. They are the ones who were attracted to residential real estate investing in the first place by discounts and without them, they will have a more difficult time achieving a return on investment better than they can get elsewhere.

Two years ago, foreclosures regularly sold for 30 percent or more below the price of “normal” homes. How times have change! Now the foreclosure discount is less than half that amount and still headed south. The discounts investors receive for buying homes that have languished in default, are what attracted most investors to real estate in the first place. Foreclosure discounts, however, were also widely blamed-fairly or unfairly–for lowering home values when appraisers mixed them in with other comparable properties when valuing a home. This practice was so controversial that it contributed to a two-year long, highly charged re-do of appraisal guidelines and today appraisers are discouraged from using foreclosures as comps. As the discount has declined, the problem with appraisals is disappearing but investors are facing some tough decisions. The latest data, from the National Association of Realtors Realtor Confidence Index survey of 3400 plus Realtors suggests that for REOs the discount has fallen to 16 percent average discount to market, while short sales are selling at a 13 percent average discount. For properties in average or better condition, the discount is now only 11 percent. The demise of the foreclosure discount may become a major factor in changing the nature of residential real estate investing. Despite the entry of big investors into real estate, small “mom and pops” still account for the vast majority of foreclosure sales. They are the ones who were attracted to residential real estate investing in the first place by discounts and without them, they will have a more difficult time achieving a return on investment better than they can get elsewhere.

More than half of all homes sold last year and in 2013, so far, have been purchased mortgage-free, according to economists at Goldman Sachs Group. Prior to the housing crash, about 20 percent of all homes sold were purchased without financing. All-cash sales have more than doubled over the last seven years. The analysis estimates that around 20% of all homes sold before the housing crash were “all-cash” sales. The surprisingly large cash-share of purchases helps to explain why home sales have jumped over the past two years despite smaller increases in the new mortgage activity indexes, such as the MBA’s mortgage application index. The analysis also estimates that around 44 cents of every $1 of homes sold currently is being financed, compared to 67 cents before the crisis. There’s no exact way to know who is responsible for all of these cash purchases, though they are likely to include some combination of investors, foreign buyers, and wealthy homeowners that don’t want to go through the hassle of getting a mortgage before closing on a sale. The Goldman study analyzed home sales figures from the Census Bureau and the National Association of Realtors and mortgage-origination data from the Mortgage Bankers Association and Lender Processing Services.

More than half of all homes sold last year and in 2013, so far, have been purchased mortgage-free, according to economists at Goldman Sachs Group. Prior to the housing crash, about 20 percent of all homes sold were purchased without financing. All-cash sales have more than doubled over the last seven years. The analysis estimates that around 20% of all homes sold before the housing crash were “all-cash” sales. The surprisingly large cash-share of purchases helps to explain why home sales have jumped over the past two years despite smaller increases in the new mortgage activity indexes, such as the MBA’s mortgage application index. The analysis also estimates that around 44 cents of every $1 of homes sold currently is being financed, compared to 67 cents before the crisis. There’s no exact way to know who is responsible for all of these cash purchases, though they are likely to include some combination of investors, foreign buyers, and wealthy homeowners that don’t want to go through the hassle of getting a mortgage before closing on a sale. The Goldman study analyzed home sales figures from the Census Bureau and the National Association of Realtors and mortgage-origination data from the Mortgage Bankers Association and Lender Processing Services.

If you’re thinking about selling your home, there are two things that you probably want: to sell it for a high price, and to sell your house fast with as little hassle as possible. The market is currently trending in favor of the seller side of the real estate transaction, which means this is doable, if follow some wise advise. First, Use a Realtor. Even in a sellers market, it’s highly unlikely that you’ll sell your house fast without a realtor. Besides the knowledge and skill that comes from with years of experience, a real estate professional has the administrative support to handle everything from calls scheduling showings to fax machines that receive the offers. A realtor will help you sell your house as quickly as possible. Second, Be Emotionally Ready. Perhaps the largest roadblock to selling a house quickly is that you aren’t emotionally ready to sell, and so you don’t take the steps you need to get your house ready to market. Only once you are ready to let go of your home will you be able to get in the best place for a quick sale. If you aren’t ready, you won’t take your realtor’s advice about getting rid of mementos because you’ll be personally offended. Or you won’t fix things because you’ll think that the buyers will be OK with the damage — just as you lived with it all these years. Third, Stage and Declutter. The No. 1 way to sell your house quickly is to have it show like a model home. Preparing you home to hit the market takes a lot of work, in fact it should take at least the equivalent of a 40 hour work week. Pack up clutter, move furniture to the garage, post on Craigslist and give things to charity. Friends and family should not recognize the listing photos of your house because it looks so different from all of the staging and decluttering. Fourth, Use The Realtor’s Listing Price. This piece of advice is going to be controversial — but I believe that you should list your home at the listing price your realtor recommends. Ideally, you’ll have interviewed several realtors and have chosen the one that you feel is the best experienced in your market. If that’s the case, choose a list price in the range they suggest based on market research.

If you’re thinking about selling your home, there are two things that you probably want: to sell it for a high price, and to sell your house fast with as little hassle as possible. The market is currently trending in favor of the seller side of the real estate transaction, which means this is doable, if follow some wise advise. First, Use a Realtor. Even in a sellers market, it’s highly unlikely that you’ll sell your house fast without a realtor. Besides the knowledge and skill that comes from with years of experience, a real estate professional has the administrative support to handle everything from calls scheduling showings to fax machines that receive the offers. A realtor will help you sell your house as quickly as possible. Second, Be Emotionally Ready. Perhaps the largest roadblock to selling a house quickly is that you aren’t emotionally ready to sell, and so you don’t take the steps you need to get your house ready to market. Only once you are ready to let go of your home will you be able to get in the best place for a quick sale. If you aren’t ready, you won’t take your realtor’s advice about getting rid of mementos because you’ll be personally offended. Or you won’t fix things because you’ll think that the buyers will be OK with the damage — just as you lived with it all these years. Third, Stage and Declutter. The No. 1 way to sell your house quickly is to have it show like a model home. Preparing you home to hit the market takes a lot of work, in fact it should take at least the equivalent of a 40 hour work week. Pack up clutter, move furniture to the garage, post on Craigslist and give things to charity. Friends and family should not recognize the listing photos of your house because it looks so different from all of the staging and decluttering. Fourth, Use The Realtor’s Listing Price. This piece of advice is going to be controversial — but I believe that you should list your home at the listing price your realtor recommends. Ideally, you’ll have interviewed several realtors and have chosen the one that you feel is the best experienced in your market. If that’s the case, choose a list price in the range they suggest based on market research.

Once upon a time, living green meant doing with less and sacrificing on creature comforts. Technology has changed all that and provided the opportunity to reset consumers expectations. Today sustainability is not about sacrifice , but an improved quality of life. Green homes are more comfortable and healthier, and the trend is no short term fad. Green homes are expected to grow to over 30 percent of the market by 2016. Buyers today are looking beyond, location, floor plan and price point, now they are considering sustainability. Younger buyers have been raised on the principles of reduce, reuse and recycle. Active older adults come from a different perspective having been paying rising utility bills for years, and are ready for more efficient solutions. Homes now consume typically twice as much energy and water as homeowners actually utilize. Over a 30 year mortgage they waste more than $70,000 in utilities. Green improvements change the economics, they can make a home safer, more comfortable and healthier. Sustainable homes incorporate a range of systems, tactics and practices. The can use reclaimed building materials, water conserving measures, sustainable landscaping, smart home technology like multi-zone HVAC to lessen the environmental impact. Simple tips for homeowners include: 1) Log on to

Once upon a time, living green meant doing with less and sacrificing on creature comforts. Technology has changed all that and provided the opportunity to reset consumers expectations. Today sustainability is not about sacrifice , but an improved quality of life. Green homes are more comfortable and healthier, and the trend is no short term fad. Green homes are expected to grow to over 30 percent of the market by 2016. Buyers today are looking beyond, location, floor plan and price point, now they are considering sustainability. Younger buyers have been raised on the principles of reduce, reuse and recycle. Active older adults come from a different perspective having been paying rising utility bills for years, and are ready for more efficient solutions. Homes now consume typically twice as much energy and water as homeowners actually utilize. Over a 30 year mortgage they waste more than $70,000 in utilities. Green improvements change the economics, they can make a home safer, more comfortable and healthier. Sustainable homes incorporate a range of systems, tactics and practices. The can use reclaimed building materials, water conserving measures, sustainable landscaping, smart home technology like multi-zone HVAC to lessen the environmental impact. Simple tips for homeowners include: 1) Log on to  Buying your first home can be one of the most exciting events in adult life. In many ways, it’s our society’s primary marker of adulthood, a symbol of financial prudence, and the ultimate sign of stability. But without the right planning, buying your first place can be fraught with stress, fear, and way too much guesswork. Here are five financial prerequisites that, are musts before you sign on the dotted line.

Buying your first home can be one of the most exciting events in adult life. In many ways, it’s our society’s primary marker of adulthood, a symbol of financial prudence, and the ultimate sign of stability. But without the right planning, buying your first place can be fraught with stress, fear, and way too much guesswork. Here are five financial prerequisites that, are musts before you sign on the dotted line.

Odds are you bought your first house several years ago. First-time homebuyers get a lot of attention — there are numerous articles and tips about being a first-time homebuyer. And you probably read a lot before buying your first house. But second-time homebuyers? There’s little advice available. Here are a few things I wish I knew before buying a second house.

Odds are you bought your first house several years ago. First-time homebuyers get a lot of attention — there are numerous articles and tips about being a first-time homebuyer. And you probably read a lot before buying your first house. But second-time homebuyers? There’s little advice available. Here are a few things I wish I knew before buying a second house.