California Leading The Recovery

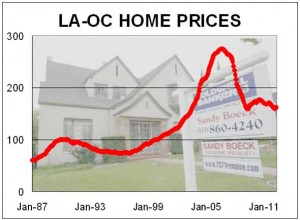

Blog, Market Updates, Real Estate News, Real Estate Tips | Dunham Stewart Major California markets have cut inventory dramatically, reduced REOs and now are witnessing growing demand and improving prices. The state that gave America Alt-A loans, Countrywide, the first tidal wave of foreclosures, the highest prices during the boom and the fastest fall during the bust now is leading the nation out of the six-year housing depression. In the second quarter, California replaced Florida as the state dominating Realtor.com’s quarterly list of top turnaround towns. In the first quarter of 2012, seven Florida markets and one California market made the top 10 positions in the Realtor.com ranking. Just one market in Florida and six in California now dominate the first 10 positions. The California Association of Realtors reports prices continued to improve, with the median home price posting both month-over-month and year-over-year gains for the fourth consecutive month in June.

Major California markets have cut inventory dramatically, reduced REOs and now are witnessing growing demand and improving prices. The state that gave America Alt-A loans, Countrywide, the first tidal wave of foreclosures, the highest prices during the boom and the fastest fall during the bust now is leading the nation out of the six-year housing depression. In the second quarter, California replaced Florida as the state dominating Realtor.com’s quarterly list of top turnaround towns. In the first quarter of 2012, seven Florida markets and one California market made the top 10 positions in the Realtor.com ranking. Just one market in Florida and six in California now dominate the first 10 positions. The California Association of Realtors reports prices continued to improve, with the median home price posting both month-over-month and year-over-year gains for the fourth consecutive month in June.

Nearly seven years after the housing bubble burst, most indexes of house prices are bending up. The U.S. finally has moved beyond attention-grabbing predictions from housing “experts” that housing is bottoming. The numbers are now convincing. The reduced inventory of unsold homes is key. For the past couple of years, house prices have risen in the spring and then slumped; the declining supply of houses for sale is reason to believe that won’t happen again this year. Builders began work on 26% more single-family homes in May 2012 than the depressed levels of May 2011. The stock of unsold newly built homes is back to 2005 levels. In each of the past four quarters, housing construction has added to economic growth. Economists aren’t always right, but on this at least they agree: A new Wall Street Journal survey of forecasters found 44 believe the housing market has reached its bottom; only three don’t. Check out some of the graphs and charts:

Nearly seven years after the housing bubble burst, most indexes of house prices are bending up. The U.S. finally has moved beyond attention-grabbing predictions from housing “experts” that housing is bottoming. The numbers are now convincing. The reduced inventory of unsold homes is key. For the past couple of years, house prices have risen in the spring and then slumped; the declining supply of houses for sale is reason to believe that won’t happen again this year. Builders began work on 26% more single-family homes in May 2012 than the depressed levels of May 2011. The stock of unsold newly built homes is back to 2005 levels. In each of the past four quarters, housing construction has added to economic growth. Economists aren’t always right, but on this at least they agree: A new Wall Street Journal survey of forecasters found 44 believe the housing market has reached its bottom; only three don’t. Check out some of the graphs and charts:  Today is a tempting time to buy a home with interest rates and prices at their lowest levels in years. Deciding whether to buy or rent can be complicated, and potential homebuyers have a lot to consider this summer. Here are the somee key questions to help shoppers make wise financial choices when considering buying a home. 1. How much can you afford to put down? Can you afford the monthly payment? The size of the down payment will impact the monthly cost. 2. What other debt do you have? Aim to keep total rent or mortgage payments plus other credit obligations fewer than 35 to 40 percent of your monthly income. 3. What is my credit score? Can I qualify for a good interest rate? For instance, a borrower with a score of 760 could pay nearly 2 percentage points less in interest than someone with a score of 620. That equates to over $3,000 less in mortgage payments each year. 4. How much will taxes, monthly maintenance or other fees cost? Remember to factor in these costs and incentives. Renters have neither these costs, nor tax advantages. 5. How many years will I stay here? Generally, the longer you plan to live someplace, the more it makes sense to buy. Over time, you can build equity in your house where renters do not.

Today is a tempting time to buy a home with interest rates and prices at their lowest levels in years. Deciding whether to buy or rent can be complicated, and potential homebuyers have a lot to consider this summer. Here are the somee key questions to help shoppers make wise financial choices when considering buying a home. 1. How much can you afford to put down? Can you afford the monthly payment? The size of the down payment will impact the monthly cost. 2. What other debt do you have? Aim to keep total rent or mortgage payments plus other credit obligations fewer than 35 to 40 percent of your monthly income. 3. What is my credit score? Can I qualify for a good interest rate? For instance, a borrower with a score of 760 could pay nearly 2 percentage points less in interest than someone with a score of 620. That equates to over $3,000 less in mortgage payments each year. 4. How much will taxes, monthly maintenance or other fees cost? Remember to factor in these costs and incentives. Renters have neither these costs, nor tax advantages. 5. How many years will I stay here? Generally, the longer you plan to live someplace, the more it makes sense to buy. Over time, you can build equity in your house where renters do not.

This US Report suggests what we are experiencing in our local housing market. We have seen a positive turn in 2012, and the popular opinion is that we will continue to see an improving real estate market. We have begun to see some rising home prices in the region, continuing a slight rebound for a second straight month. While one month does not make a trend, particularly during seasonally strong buying months, the combination of rising positive monthly index levels and improving annual returns is a good sign. Although home prices have not necessarily seen a significant increase, we have seen an increase and speed of which homes are selling – and with a lot of sales for over-asking price. The expecttions is that only a matter of time until the market clearly reflects an increase in home prices. We are expecting home prices to cautiously start moving up into and thrrough 2013. Click this link to view the

This US Report suggests what we are experiencing in our local housing market. We have seen a positive turn in 2012, and the popular opinion is that we will continue to see an improving real estate market. We have begun to see some rising home prices in the region, continuing a slight rebound for a second straight month. While one month does not make a trend, particularly during seasonally strong buying months, the combination of rising positive monthly index levels and improving annual returns is a good sign. Although home prices have not necessarily seen a significant increase, we have seen an increase and speed of which homes are selling – and with a lot of sales for over-asking price. The expecttions is that only a matter of time until the market clearly reflects an increase in home prices. We are expecting home prices to cautiously start moving up into and thrrough 2013. Click this link to view the Negative equity, which is the result of homeowners owing more on their mortgages than their homes are worth, has always been viewed as a detriment to the housing economy because it freezes owners in their homes and makes them liable to foreclosure. At a recent panel at the National Association of Realtors conference, Zillow’s chief economist put a different spin on negative equity. Stan Humphries argued that current market conditions, when inventories are at record lows and negative equity afflicts 31.4 percent of all homeowners with a mortgage, negative equity is not only diminishing demand it is also reducing the available supply of homes for sale by making it impossible for owners to sell without taking a loss. Lower inventories lead to price increases and at some point values rise sufficiently to move number of owners above water, and making it possible for them to sell, resulting in a temporary increase in inventories. Prices might plateau temporarily until demand reduces inventories again and prices resume their climb. The expecttion is for median prices to rise ten percent on an annual basis a year from now.

Negative equity, which is the result of homeowners owing more on their mortgages than their homes are worth, has always been viewed as a detriment to the housing economy because it freezes owners in their homes and makes them liable to foreclosure. At a recent panel at the National Association of Realtors conference, Zillow’s chief economist put a different spin on negative equity. Stan Humphries argued that current market conditions, when inventories are at record lows and negative equity afflicts 31.4 percent of all homeowners with a mortgage, negative equity is not only diminishing demand it is also reducing the available supply of homes for sale by making it impossible for owners to sell without taking a loss. Lower inventories lead to price increases and at some point values rise sufficiently to move number of owners above water, and making it possible for them to sell, resulting in a temporary increase in inventories. Prices might plateau temporarily until demand reduces inventories again and prices resume their climb. The expecttion is for median prices to rise ten percent on an annual basis a year from now.

These are the darlings of garden designers and are easy to grow and maintain. Warm-season grasses wake up in the second half of spring, when temperatures start to rise and the soil begins to warm. They grow and bloom through summer’s heat and often peak in fall. Many remain attractive through dormancy into winter, and all require little more than an early spring haircut before growth begins for maintenance. This post is about the ornamental grasses that bring great richness of texture, variety, and beauty to set off your finest flowers. Grasses add interest to a garden by changing with the seasons. They don’t disappear; instead, they evolve throughout the year. One season brings the striking foliage, then perhaps the elegant plume of bloom, and in the fall, another look as the plant prepares for the winter. All make wonderful accents in the garden. Here is a great post with photos and tips:

These are the darlings of garden designers and are easy to grow and maintain. Warm-season grasses wake up in the second half of spring, when temperatures start to rise and the soil begins to warm. They grow and bloom through summer’s heat and often peak in fall. Many remain attractive through dormancy into winter, and all require little more than an early spring haircut before growth begins for maintenance. This post is about the ornamental grasses that bring great richness of texture, variety, and beauty to set off your finest flowers. Grasses add interest to a garden by changing with the seasons. They don’t disappear; instead, they evolve throughout the year. One season brings the striking foliage, then perhaps the elegant plume of bloom, and in the fall, another look as the plant prepares for the winter. All make wonderful accents in the garden. Here is a great post with photos and tips:  Landscape design is a process of developing practical and pleasing outdoor living space. Bring energy and movement to your landscape by applying these universal principles to your plant and paver designs. Even though these rules are universal, the principles of landscape design include the elements of unity, scale, balance, simplicity, variety, emphasis, and rythm. Unity attracts and holds attention. Scale evokes emotional connection. Balance is equilibruim on the left and right sides. Simplicity is the degrees of repetition rather than constant change, creating unity. Variety is diversity and contrast in form, texture, and color preventing monotony. Emphasis is the dominance and subordination of elements. Rythm is the change or flow in form, color, texture and size giving movement. This article explains and shows some cool ways to infuse your landscape with a dynamic rhythm. Check out:

Landscape design is a process of developing practical and pleasing outdoor living space. Bring energy and movement to your landscape by applying these universal principles to your plant and paver designs. Even though these rules are universal, the principles of landscape design include the elements of unity, scale, balance, simplicity, variety, emphasis, and rythm. Unity attracts and holds attention. Scale evokes emotional connection. Balance is equilibruim on the left and right sides. Simplicity is the degrees of repetition rather than constant change, creating unity. Variety is diversity and contrast in form, texture, and color preventing monotony. Emphasis is the dominance and subordination of elements. Rythm is the change or flow in form, color, texture and size giving movement. This article explains and shows some cool ways to infuse your landscape with a dynamic rhythm. Check out:  Growth in home sales appears to be driven by the willingness of sellers to lower their prices rather than a broad-based increase in demand and buyer confidence, according to an analysis by real estate data and analytics firm Radar Logic Inc. In “

Growth in home sales appears to be driven by the willingness of sellers to lower their prices rather than a broad-based increase in demand and buyer confidence, according to an analysis by real estate data and analytics firm Radar Logic Inc. In “ The South Park Design Committee invites residents to weigh in on the design of the playground, to replace part of the unused skate rink in the park. The design of the play area remains in the hands of the community. Committee members and residents have been meeting at the bleachers in the park around 9 a.m. every Saturday to discuss the playground plans and share ideas. The goal is to make the playground a community project. For example, the committee plans to launch a design contest to get children’s input on design plans from both Hermosa View and Valley Schools, as well as the

The South Park Design Committee invites residents to weigh in on the design of the playground, to replace part of the unused skate rink in the park. The design of the play area remains in the hands of the community. Committee members and residents have been meeting at the bleachers in the park around 9 a.m. every Saturday to discuss the playground plans and share ideas. The goal is to make the playground a community project. For example, the committee plans to launch a design contest to get children’s input on design plans from both Hermosa View and Valley Schools, as well as the  Homeowners are ready to make 2012 a banner year for remodeling and the latest cost-for-value research suggests that getting the most bang for every buck is more important than ever. Remodeling Magazine’s annual Cost vs. Value report for 2011-2012 found that the trend right now is replacement over remodeling-swapping out the old for the new rather than doing a total gut job, which can be much more costly. Living space and the way it’s utilized also continues to be top of mind. The trend not to invest in the bigger, but instead investing in what’s better. The Remodeling Market Index (RMI) hit a five-year high at the end of 2011, indicating that residential remodeling should continue to grow in 2012. Here are some of the projects that offer the best return on investment, allowing home owners to recoup close to 70 percent or more of the costs of the project at times of resale. Check out the report:

Homeowners are ready to make 2012 a banner year for remodeling and the latest cost-for-value research suggests that getting the most bang for every buck is more important than ever. Remodeling Magazine’s annual Cost vs. Value report for 2011-2012 found that the trend right now is replacement over remodeling-swapping out the old for the new rather than doing a total gut job, which can be much more costly. Living space and the way it’s utilized also continues to be top of mind. The trend not to invest in the bigger, but instead investing in what’s better. The Remodeling Market Index (RMI) hit a five-year high at the end of 2011, indicating that residential remodeling should continue to grow in 2012. Here are some of the projects that offer the best return on investment, allowing home owners to recoup close to 70 percent or more of the costs of the project at times of resale. Check out the report: