Time To Sell Real Estate

Blog, Market Updates, Real Estate Tips, Selling | Dunham Stewart

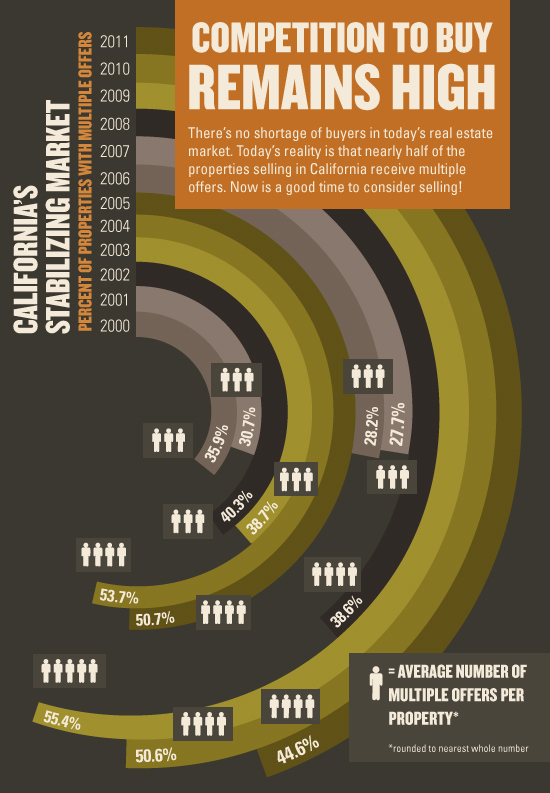

{Infographic} With Southern California moving swiftly ahead in the direction of real estate recovery, now is the time for move-up buyers to capitalize on comparatively low home prices and historically low interest rates while they still can. The stabilizing real estate market is a result of a a combination of reduced defaults, increased demand in move-up markets and lively activity on the part of investors. All this means the competition to buy real estate is high with multiple offers becoming the norm.

{Infographic} With Southern California moving swiftly ahead in the direction of real estate recovery, now is the time for move-up buyers to capitalize on comparatively low home prices and historically low interest rates while they still can. The stabilizing real estate market is a result of a a combination of reduced defaults, increased demand in move-up markets and lively activity on the part of investors. All this means the competition to buy real estate is high with multiple offers becoming the norm.

The real estate market is recovering but problems with a sizeable share of real estate appraisals also are holding back home sales.

The real estate market is recovering but problems with a sizeable share of real estate appraisals also are holding back home sales.  The real estate market has seen a continuing reduction in the volume of distressed properties seen in the housing market. The result has been a recent boost to home prices in many parts of the Southern California. Meanwhile, there is still uncertainty about the impact of next month’s national elections shich appears to be causing some would-be homebuyers to delay taking any action until after November, according to the October HousingPulse survey of real estate agents. The survey found that one major reason behind the rise in home prices is a fairly sharp drop in the share of distressed properties found in recent home sales. A drop in the share of distressed properties in the housing market is most obvious indicator contributing to lower leve er foreclosed properties or real estate owned (REO) being put up for sale by banks. The survey respondents reported in October that major banks appear to be keeping many REO properties off the market this year. But they also suggest banks may be looking to unload significant amounts of REO next year – a move that could put downward pressure on home prices.

The real estate market has seen a continuing reduction in the volume of distressed properties seen in the housing market. The result has been a recent boost to home prices in many parts of the Southern California. Meanwhile, there is still uncertainty about the impact of next month’s national elections shich appears to be causing some would-be homebuyers to delay taking any action until after November, according to the October HousingPulse survey of real estate agents. The survey found that one major reason behind the rise in home prices is a fairly sharp drop in the share of distressed properties found in recent home sales. A drop in the share of distressed properties in the housing market is most obvious indicator contributing to lower leve er foreclosed properties or real estate owned (REO) being put up for sale by banks. The survey respondents reported in October that major banks appear to be keeping many REO properties off the market this year. But they also suggest banks may be looking to unload significant amounts of REO next year – a move that could put downward pressure on home prices.

Nearly seven years after the housing bubble burst, most indexes of house prices are bending up. The U.S. finally has moved beyond attention-grabbing predictions from housing “experts” that housing is bottoming. The numbers are now convincing. The reduced inventory of unsold homes is key. For the past couple of years, house prices have risen in the spring and then slumped; the declining supply of houses for sale is reason to believe that won’t happen again this year. Builders began work on 26% more single-family homes in May 2012 than the depressed levels of May 2011. The stock of unsold newly built homes is back to 2005 levels. In each of the past four quarters, housing construction has added to economic growth. Economists aren’t always right, but on this at least they agree: A new Wall Street Journal survey of forecasters found 44 believe the housing market has reached its bottom; only three don’t. Check out some of the graphs and charts:

Nearly seven years after the housing bubble burst, most indexes of house prices are bending up. The U.S. finally has moved beyond attention-grabbing predictions from housing “experts” that housing is bottoming. The numbers are now convincing. The reduced inventory of unsold homes is key. For the past couple of years, house prices have risen in the spring and then slumped; the declining supply of houses for sale is reason to believe that won’t happen again this year. Builders began work on 26% more single-family homes in May 2012 than the depressed levels of May 2011. The stock of unsold newly built homes is back to 2005 levels. In each of the past four quarters, housing construction has added to economic growth. Economists aren’t always right, but on this at least they agree: A new Wall Street Journal survey of forecasters found 44 believe the housing market has reached its bottom; only three don’t. Check out some of the graphs and charts:  City officials have noticed an uptick in new condominium projects in Hermosa Beach this year, continuing a trend that began in Manhattan Beach. Community Development Director Ken Robertson said his office has received six applications this year for condo projects, which range between two and four units. In 2009 and 2011, the city received just two applications for multi-unit condo projects. After having no condo projects in 2009, the city of Manhattan Beach approved a total of five in 2010 and 2011. Although no applications have been filed so far this year, Manhattan Beach building officials, expects that to change in the second half of the year. The number of new single family homes being built continues to increase over the past three years, and permits for home remodeling and additions are increasing by 30 percent year-to-year since 2010. In Hermosa, the number of new single family homes approved went from 8 in 2010 to 19 in 2011, with five so far this year. When you see this volume of application in a short period like this it really shows that things in the residential construction or development market are changing, Generally this is an indicator that more speculative type of development is going on rather than custom home remodels or custom home building.

City officials have noticed an uptick in new condominium projects in Hermosa Beach this year, continuing a trend that began in Manhattan Beach. Community Development Director Ken Robertson said his office has received six applications this year for condo projects, which range between two and four units. In 2009 and 2011, the city received just two applications for multi-unit condo projects. After having no condo projects in 2009, the city of Manhattan Beach approved a total of five in 2010 and 2011. Although no applications have been filed so far this year, Manhattan Beach building officials, expects that to change in the second half of the year. The number of new single family homes being built continues to increase over the past three years, and permits for home remodeling and additions are increasing by 30 percent year-to-year since 2010. In Hermosa, the number of new single family homes approved went from 8 in 2010 to 19 in 2011, with five so far this year. When you see this volume of application in a short period like this it really shows that things in the residential construction or development market are changing, Generally this is an indicator that more speculative type of development is going on rather than custom home remodels or custom home building.

Housing affordability conditions have reached the highest level since recordkeeping began in 1970, according to the National Association of Realtors®. NAR’s Housing Affordability Index rose to a record high 206.1 in January, based on the relationship between median home price, median family income and average mortgage interest rate. The higher the index, the greater the household purchasing power. An index of 100 is defined as the point where a median-income household has exactly enough income to qualify for the purchase of a median-priced existing single-family homeThe projections for the affordability index for all of 2012 will be at an annual high, with little movement in mortgage interest rates or home prices during the year. Read the full story at Realor.org:

Housing affordability conditions have reached the highest level since recordkeeping began in 1970, according to the National Association of Realtors®. NAR’s Housing Affordability Index rose to a record high 206.1 in January, based on the relationship between median home price, median family income and average mortgage interest rate. The higher the index, the greater the household purchasing power. An index of 100 is defined as the point where a median-income household has exactly enough income to qualify for the purchase of a median-priced existing single-family homeThe projections for the affordability index for all of 2012 will be at an annual high, with little movement in mortgage interest rates or home prices during the year. Read the full story at Realor.org:  Growth in home sales appears to be driven by the willingness of sellers to lower their prices rather than a broad-based increase in demand and buyer confidence, according to an analysis by real estate data and analytics firm Radar Logic Inc. In “

Growth in home sales appears to be driven by the willingness of sellers to lower their prices rather than a broad-based increase in demand and buyer confidence, according to an analysis by real estate data and analytics firm Radar Logic Inc. In “ More Americans are signing contracts to buy existing homes than at any time in nearly two years, boosting the housing industry’s slow recovery, according to the National Association of REALTORS®’ index of pending home sales. Last month saw the highest point on the index since April 2010, when consumers drawn by a home-buyer tax credit pushed the figure to 111.3. That was the last time the measure exceeded 100 — the benchmark for industry health. The index showed year-over-year increases in every region.

More Americans are signing contracts to buy existing homes than at any time in nearly two years, boosting the housing industry’s slow recovery, according to the National Association of REALTORS®’ index of pending home sales. Last month saw the highest point on the index since April 2010, when consumers drawn by a home-buyer tax credit pushed the figure to 111.3. That was the last time the measure exceeded 100 — the benchmark for industry health. The index showed year-over-year increases in every region.

With the start of the home buying season just around the corner, years of low prices and dashed hopes for the long awaited housing recovery may be changing the way sellers price and prep their properties. More than half (51 percent) of 600 agents in a recent real estate franchise survey reported that sellers are more willing to price their homes competitively than this time last year and 45 percent said sellers are more willing to change the appearance of their homes to entice buyers than they were one year ago. Last year, by contrast, many sellers refused to budge on their prices. One reason was the high percentage, some 22 percent of home owners with a mortgage, who owe more thantheir home is currently worth are not in a position to negotiate. Also, some sellers were willing to wait in hopes of getting a higher price. A factor currently working in sellers’ favor is a dramatically lower number of homes for sale, which may change with spring time. The national for-sale inventory dropped by 6.59 percent in January, the eighth consecutive month of decline. The total number of listings on Realtor.com is now 23.20 percent below the levels observed in January 2011.

With the start of the home buying season just around the corner, years of low prices and dashed hopes for the long awaited housing recovery may be changing the way sellers price and prep their properties. More than half (51 percent) of 600 agents in a recent real estate franchise survey reported that sellers are more willing to price their homes competitively than this time last year and 45 percent said sellers are more willing to change the appearance of their homes to entice buyers than they were one year ago. Last year, by contrast, many sellers refused to budge on their prices. One reason was the high percentage, some 22 percent of home owners with a mortgage, who owe more thantheir home is currently worth are not in a position to negotiate. Also, some sellers were willing to wait in hopes of getting a higher price. A factor currently working in sellers’ favor is a dramatically lower number of homes for sale, which may change with spring time. The national for-sale inventory dropped by 6.59 percent in January, the eighth consecutive month of decline. The total number of listings on Realtor.com is now 23.20 percent below the levels observed in January 2011.

Pent-up demand could finally be working its way through the market. Pending home sales rose sharply in October according to the National Association of Realtors. The latest statistics reveal that contract signings rose 10.4 percent for the month and are now 9.4 percent above 2010 levels. This is an encouraging sign that pent up consumer demand building over the past several years could finally translate into meaningful improvement for the housing market. The driving force behind this improvement increased affordability, from record low mortgage rates and downward pressure on pricing. Read more

Pent-up demand could finally be working its way through the market. Pending home sales rose sharply in October according to the National Association of Realtors. The latest statistics reveal that contract signings rose 10.4 percent for the month and are now 9.4 percent above 2010 levels. This is an encouraging sign that pent up consumer demand building over the past several years could finally translate into meaningful improvement for the housing market. The driving force behind this improvement increased affordability, from record low mortgage rates and downward pressure on pricing. Read more