November Market Update

Blog, Buying, Dunham Stewart, Market Minutes, Market Updates, Real Estate News, Real Estate Tips, Uncategorized | Dunham StewartU.S. Mortgage Rates Dip in Mid-November

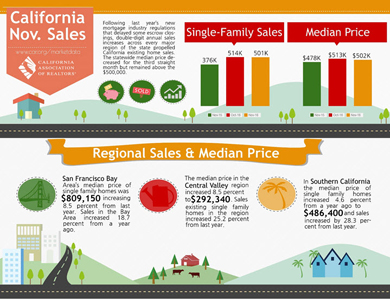

According to Freddie Mac’s latest Primary Mortgage Market Survey, the average U.S. mortgage rate slightly dipped across the board.

Sean Becketti, chief economist of Freddie Mac said, “After holding steady last week, rates dipped slightly this week. The 10-year Treasury yield fell roughly 7 basis points, while the 30-year mortgage rate dropped 4 basis points to 3.90 percent.”

Freddie Mac News Facts

- 30-year fixed-rate mortgage (FRM) averaged 3.90 percent with an average 0.4 point for the week ending November 9, 2017, down from last week when it averaged 3.94 percent. A year ago at this time, the 30-year FRM averaged 3.57 percent.

- 15-year FRM this week averaged 3.24 percent with an average 0.5 point, down from last week when it averaged 3.27 percent. A year ago at this time, the 15-year FRM averaged 2.88 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.22 percent this week with an average 0.5 point, down from last week when it averaged 3.23 percent. A year ago at this time, the 5-year ARM averaged 2.88 percent.

Read more local and national news HERE