Luxury Home Market Turning For Sellers

Blog, Manhattan Beach News, Market Updates, Selling | Dunham Stewart Top tier properties are getting close to ending their multi-year buyers’ market and quickly reaching a more equal balance between buyers and sellers, catching up with less expensive homes . Since early December, the Institute for Luxury Home Marketing’s Market Action Index has risen 30 percent and is now only seven points away from reaching a seller’s market on a national level. The index, which is managed by Altos Research, measures available supply relative to the current level of demand. Despite the fact that the number of new listings has increased 51 percent over the past six weeks, the average days on market at 204 has declined slightly, from 209 to 204. Luxury homes typically take longer to sell than less expensive ones and the ILHM average days on market (204) are much higher than Realtor.com’s January median of 119 days for all price ranges. The percent of properties with a price decrease, another sign of buyer dominance, has also decreased over the past six weeks, from 26 percent to 24 percent of all luxury properties.

Top tier properties are getting close to ending their multi-year buyers’ market and quickly reaching a more equal balance between buyers and sellers, catching up with less expensive homes . Since early December, the Institute for Luxury Home Marketing’s Market Action Index has risen 30 percent and is now only seven points away from reaching a seller’s market on a national level. The index, which is managed by Altos Research, measures available supply relative to the current level of demand. Despite the fact that the number of new listings has increased 51 percent over the past six weeks, the average days on market at 204 has declined slightly, from 209 to 204. Luxury homes typically take longer to sell than less expensive ones and the ILHM average days on market (204) are much higher than Realtor.com’s January median of 119 days for all price ranges. The percent of properties with a price decrease, another sign of buyer dominance, has also decreased over the past six weeks, from 26 percent to 24 percent of all luxury properties.

Nailing the day that a home listing debuts is crucial, homes get four times the traffic on the day of debut than any other time of the week. Last year, homes listed on Fridays sold for 99.1% of the seller’s original asking price, the highest percentage of any day of the week. One day of the week can mean an extra $5,000 in a home-seller’s pocket. Listing a home on a Friday rather than a Sunday—the worst day to debut—could mean a difference of nearly $5,000 on a $500,000 house. Properties listed on Fridays also sell the fastest. What makes Fridays so special? Adults who have a Monday-to-Friday workweek tend to be more positive and happier on Fridays, an effect that lasts through the weekend. They also tend to report more vitality and energy on the weekends, which may prompt them to be more proactive in searching for homes. Conversely, Sunday listings have to sit around for a few days before people start lining up home tours for the following weekend. One other day seems to dominate the real-estate world: Tuesday. Homes that are listed on a Tuesday garner the most interest for home tours, Tuesdays are big planning days for many people.

Nailing the day that a home listing debuts is crucial, homes get four times the traffic on the day of debut than any other time of the week. Last year, homes listed on Fridays sold for 99.1% of the seller’s original asking price, the highest percentage of any day of the week. One day of the week can mean an extra $5,000 in a home-seller’s pocket. Listing a home on a Friday rather than a Sunday—the worst day to debut—could mean a difference of nearly $5,000 on a $500,000 house. Properties listed on Fridays also sell the fastest. What makes Fridays so special? Adults who have a Monday-to-Friday workweek tend to be more positive and happier on Fridays, an effect that lasts through the weekend. They also tend to report more vitality and energy on the weekends, which may prompt them to be more proactive in searching for homes. Conversely, Sunday listings have to sit around for a few days before people start lining up home tours for the following weekend. One other day seems to dominate the real-estate world: Tuesday. Homes that are listed on a Tuesday garner the most interest for home tours, Tuesdays are big planning days for many people.

The percentage of home buyers writing offers in January increased by 12 percentage points according to Redfine and 23 percent of Americans think it is a good time to sell compared to 11 percent the same time last year, according to Fannie Mae’s January 2013 National Housing Survey results. The increase in homebuyer demand seen in January paired with a nation-wide inventory shortage has created an extreme seller’s market, bidding wars involving multiple offers have become increasingly common. There are two factors affecting upward trend in the share of home owners who say it’s a good time to sell. First, home prices are improving. Second, the number of homeowners who are underwater is declining, this eliminates a barrier for those owners who need to sell their home in order to buy.

The percentage of home buyers writing offers in January increased by 12 percentage points according to Redfine and 23 percent of Americans think it is a good time to sell compared to 11 percent the same time last year, according to Fannie Mae’s January 2013 National Housing Survey results. The increase in homebuyer demand seen in January paired with a nation-wide inventory shortage has created an extreme seller’s market, bidding wars involving multiple offers have become increasingly common. There are two factors affecting upward trend in the share of home owners who say it’s a good time to sell. First, home prices are improving. Second, the number of homeowners who are underwater is declining, this eliminates a barrier for those owners who need to sell their home in order to buy.

We are all on the same page that it is a seller’s market today in real estate. Not enough listings to feed the appetite of well qualified buyers aching to take advantage of historic low interest rates. If you are a buyer or a seller in today’s market, you’ll be having discussions with your Realtor to look at the comparable sales (same neighborhood, floor plan, size, number of bedrooms, condition, and location.) Your Realtor will call them “the comps.” So you’ll know what your home will sell for if you are selling, and you’ll know what you’re going to have to pay if you’re buying. Pay close attention ONLY to the comps that have actually closed in the last six to eight weeks. Prices are trending up right now and you want the most recently closed sale you can get your hands on.What’s the big secret to digging deeper to really understand the current market value today? Two things – that your Realtor reads the secret, for-agents-eyes-only remarks on the comps – because that’s where a ton of information can be found. And you won’t see it on Realtor.com, Trulia.com or Zillow.com. And secondly, having the gumption to call and ask what the story is. Haven’t had anyone hang up on me yet.

We are all on the same page that it is a seller’s market today in real estate. Not enough listings to feed the appetite of well qualified buyers aching to take advantage of historic low interest rates. If you are a buyer or a seller in today’s market, you’ll be having discussions with your Realtor to look at the comparable sales (same neighborhood, floor plan, size, number of bedrooms, condition, and location.) Your Realtor will call them “the comps.” So you’ll know what your home will sell for if you are selling, and you’ll know what you’re going to have to pay if you’re buying. Pay close attention ONLY to the comps that have actually closed in the last six to eight weeks. Prices are trending up right now and you want the most recently closed sale you can get your hands on.What’s the big secret to digging deeper to really understand the current market value today? Two things – that your Realtor reads the secret, for-agents-eyes-only remarks on the comps – because that’s where a ton of information can be found. And you won’t see it on Realtor.com, Trulia.com or Zillow.com. And secondly, having the gumption to call and ask what the story is. Haven’t had anyone hang up on me yet.

Bad neighbors with annoying pets, unkempt yards, unpleasant odors, loud music, dangerous trees and limbs, or poorly maintained exteriors can cost homeowners big time. The Appraisal Institute today cautioned homeowners and potential homebuyers that bad neighbors can significantly reduce nearby property values. Appraisers refer to this as “external obsolescence,” which is depreciation caused by external factors not on the property. External obsolescence may be caused by economic or locational factors, and may be temporary or permanent, but it is not curable by the owner, landlord or tenant. Owners and buyers should walk streets neighboring a property on several days at various times to learn more about what is happening in the neighborhood. A home’s proximity to a bad neighbor also can impact the rate of potential decline in value. Potential homebuyers also should be aware of a property’s proximity to commercial facilities, such as power plants and funeral homes, as these also can negatively affect a home’s value.

Bad neighbors with annoying pets, unkempt yards, unpleasant odors, loud music, dangerous trees and limbs, or poorly maintained exteriors can cost homeowners big time. The Appraisal Institute today cautioned homeowners and potential homebuyers that bad neighbors can significantly reduce nearby property values. Appraisers refer to this as “external obsolescence,” which is depreciation caused by external factors not on the property. External obsolescence may be caused by economic or locational factors, and may be temporary or permanent, but it is not curable by the owner, landlord or tenant. Owners and buyers should walk streets neighboring a property on several days at various times to learn more about what is happening in the neighborhood. A home’s proximity to a bad neighbor also can impact the rate of potential decline in value. Potential homebuyers also should be aware of a property’s proximity to commercial facilities, such as power plants and funeral homes, as these also can negatively affect a home’s value.

There was a time when the only source of real estate property listings information was a local real estate agent. There where big books distributed to all the local real estate brokers, listing all the local homes for sale. Today, with the advent of the internet, things have changed and all that closely guarded information is now very public. Because you know about all the homes for sale, will you be able to ensure a successful real estate transaction on your own? Let me submit that the odds are against you for several key reasons.

There was a time when the only source of real estate property listings information was a local real estate agent. There where big books distributed to all the local real estate brokers, listing all the local homes for sale. Today, with the advent of the internet, things have changed and all that closely guarded information is now very public. Because you know about all the homes for sale, will you be able to ensure a successful real estate transaction on your own? Let me submit that the odds are against you for several key reasons.

Going into 2013, home prices are expected to rise 6 percent driven by steady demand, lower bank-owned (REO) sales, and lower inventory of unsold homes. This is according to CoreLogic’s latest report. The CoreLogic Home Price Index (HPI) increased 6.3 percent in 2012, the largest increase and highest level since 2006. And year-over-year home price increases were more widespread. The two major drivers of improvement in the market have been the decline of real estate owned (REO) sales and less available inventory. The decline in REOs drove a sharp turnaround in home prices, but the impact of the decline will be less prominent in 2013. The major factor driving the market in 2013 is the lack of inventory. Current owners need to sell at prices high enough to extinguish their debt and provide equity for the next home purchase. Until home prices began to rebound in 2012, these borrowers had been effectively locked out and unable to list their homes for sale. The lock-out phenomenon, combined with the rise in investors converting foreclosures into rentals, led to a lack of for-sale inventory. These factors will continue to drive home prices rising in 2013

Going into 2013, home prices are expected to rise 6 percent driven by steady demand, lower bank-owned (REO) sales, and lower inventory of unsold homes. This is according to CoreLogic’s latest report. The CoreLogic Home Price Index (HPI) increased 6.3 percent in 2012, the largest increase and highest level since 2006. And year-over-year home price increases were more widespread. The two major drivers of improvement in the market have been the decline of real estate owned (REO) sales and less available inventory. The decline in REOs drove a sharp turnaround in home prices, but the impact of the decline will be less prominent in 2013. The major factor driving the market in 2013 is the lack of inventory. Current owners need to sell at prices high enough to extinguish their debt and provide equity for the next home purchase. Until home prices began to rebound in 2012, these borrowers had been effectively locked out and unable to list their homes for sale. The lock-out phenomenon, combined with the rise in investors converting foreclosures into rentals, led to a lack of for-sale inventory. These factors will continue to drive home prices rising in 2013

A year of record low inventories of homes for sale and improving prices may finally be catching the attention of millions of prospective home sellers. Is a seller’s market in the offing? According to a November consumer survey released today, 22 percent of homeowners said they are likely or somewhat likely to sell in 2013. Should the sales materialize, the number of homes on the market next year would increase five-fold over 2012. Annualized sales were 4.71 million (as of October), or about 6.2 percent of the nation’s 75 million owner-occupied homes. The survey found that homeowners who bought their homes between 2010 and 2012 and have owned then less than two years are more likely to sell than those who have lived in their homes longer. One out of three homeowners (33 percent) who bought their homes in the past two years said there are likely to sell next year compared to 20 percent who bought before 2002. Most of the new owners seeking to sell are probably move-up buyers who won’t be adding to the overall inventory but will be vacating entry-level homes, which are in high demand in most markets. For years, low home values have frozen move-up buyers in place, many of them underwater. Today 22 percent of owners with a mortgage still owe more than their homes are worth. Rising prices will bring out more sellers, especially if price increases lift them back above water. 2013 could be the year that inventory turns around, just as 2012 was the year that prices started recovering.

A year of record low inventories of homes for sale and improving prices may finally be catching the attention of millions of prospective home sellers. Is a seller’s market in the offing? According to a November consumer survey released today, 22 percent of homeowners said they are likely or somewhat likely to sell in 2013. Should the sales materialize, the number of homes on the market next year would increase five-fold over 2012. Annualized sales were 4.71 million (as of October), or about 6.2 percent of the nation’s 75 million owner-occupied homes. The survey found that homeowners who bought their homes between 2010 and 2012 and have owned then less than two years are more likely to sell than those who have lived in their homes longer. One out of three homeowners (33 percent) who bought their homes in the past two years said there are likely to sell next year compared to 20 percent who bought before 2002. Most of the new owners seeking to sell are probably move-up buyers who won’t be adding to the overall inventory but will be vacating entry-level homes, which are in high demand in most markets. For years, low home values have frozen move-up buyers in place, many of them underwater. Today 22 percent of owners with a mortgage still owe more than their homes are worth. Rising prices will bring out more sellers, especially if price increases lift them back above water. 2013 could be the year that inventory turns around, just as 2012 was the year that prices started recovering.

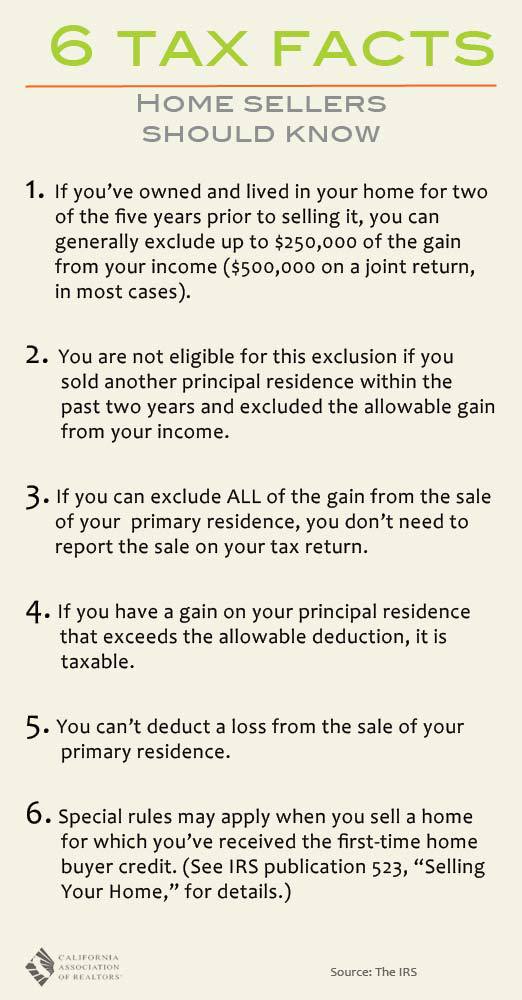

{Infographic} Thinking about selling your home? I wanted to take this opportunity to re-post these quick must know facts compiled from the IRS and the California Association of Realtors.

{Infographic} Thinking about selling your home? I wanted to take this opportunity to re-post these quick must know facts compiled from the IRS and the California Association of Realtors.