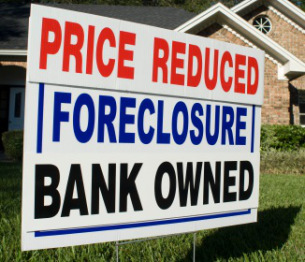

Forclosures Discounts Going, Going Gone

Blog, Real Estate Tips, Selling Two years ago, foreclosures regularly sold for 30 percent or more below the price of “normal” homes. How times have change! Now the foreclosure discount is less than half that amount and still headed south. The discounts investors receive for buying homes that have languished in default, are what attracted most investors to real estate in the first place. Foreclosure discounts, however, were also widely blamed-fairly or unfairly–for lowering home values when appraisers mixed them in with other comparable properties when valuing a home. This practice was so controversial that it contributed to a two-year long, highly charged re-do of appraisal guidelines and today appraisers are discouraged from using foreclosures as comps. As the discount has declined, the problem with appraisals is disappearing but investors are facing some tough decisions. The latest data, from the National Association of Realtors Realtor Confidence Index survey of 3400 plus Realtors suggests that for REOs the discount has fallen to 16 percent average discount to market, while short sales are selling at a 13 percent average discount. For properties in average or better condition, the discount is now only 11 percent. The demise of the foreclosure discount may become a major factor in changing the nature of residential real estate investing. Despite the entry of big investors into real estate, small “mom and pops” still account for the vast majority of foreclosure sales. They are the ones who were attracted to residential real estate investing in the first place by discounts and without them, they will have a more difficult time achieving a return on investment better than they can get elsewhere.

Two years ago, foreclosures regularly sold for 30 percent or more below the price of “normal” homes. How times have change! Now the foreclosure discount is less than half that amount and still headed south. The discounts investors receive for buying homes that have languished in default, are what attracted most investors to real estate in the first place. Foreclosure discounts, however, were also widely blamed-fairly or unfairly–for lowering home values when appraisers mixed them in with other comparable properties when valuing a home. This practice was so controversial that it contributed to a two-year long, highly charged re-do of appraisal guidelines and today appraisers are discouraged from using foreclosures as comps. As the discount has declined, the problem with appraisals is disappearing but investors are facing some tough decisions. The latest data, from the National Association of Realtors Realtor Confidence Index survey of 3400 plus Realtors suggests that for REOs the discount has fallen to 16 percent average discount to market, while short sales are selling at a 13 percent average discount. For properties in average or better condition, the discount is now only 11 percent. The demise of the foreclosure discount may become a major factor in changing the nature of residential real estate investing. Despite the entry of big investors into real estate, small “mom and pops” still account for the vast majority of foreclosure sales. They are the ones who were attracted to residential real estate investing in the first place by discounts and without them, they will have a more difficult time achieving a return on investment better than they can get elsewhere.